Content

Should your connection have multiple change or team activity, select on the an affixed declaration to help you Schedule K-step one the level of part 179 deduction out of for each and every separate hobby. The new section 1202 exclusion applies in order to QSB stock stored by the relationship for over five years. Corporate partners are not qualified to receive the brand new part 1202 exception. Declaration per partner’s display out of section 1202 acquire to your Agenda K-1. For each companion will determine whenever they qualify for the brand new area 1202 exception.

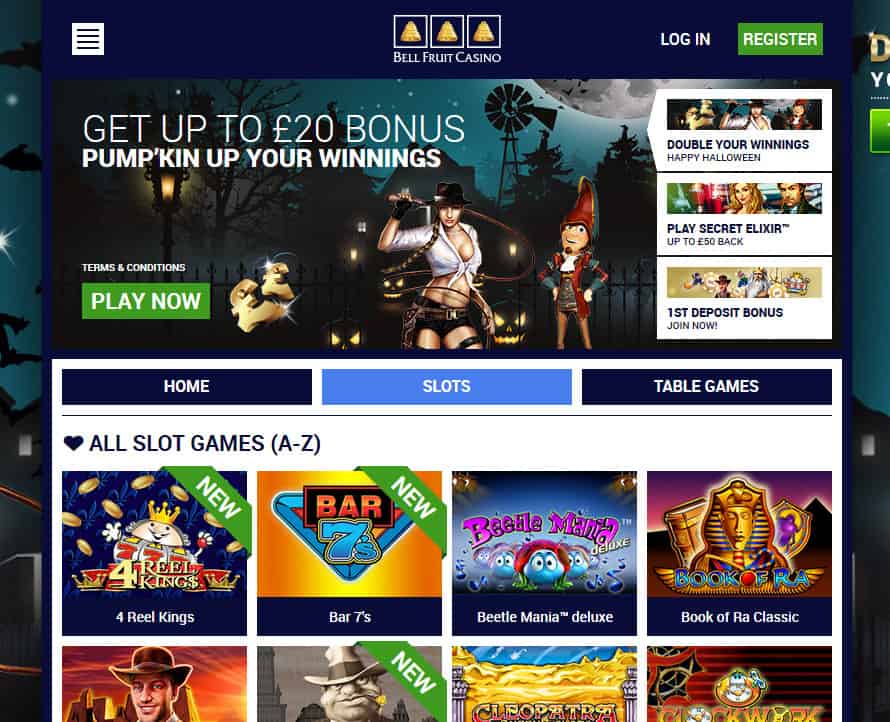

Bonus Winner casino – Activate Your Tread Overland otherwise Powersport Equipment

Simultaneously, the relationship will most likely not subtract membership dues in every bar structured to have business, fulfillment, athletics, and other social mission. Including nation clubs, tennis and you will sports clubs, trip and resorts nightclubs, and you will nightclubs manage to include meals under criteria favorable to company talk. Enter taxation and you can licenses paid back otherwise incurred on the trading or company items of your connection otherwise reflected somewhere else to the go back. Government transfer obligations and you will government excise and you may stamp fees is actually deductible only if paid off otherwise obtain inside carrying-on the newest trading or organization of your own partnership. Overseas fees come on the internet 14 only if he could be taxes not creditable but allowable below sections 901 and you will 903.

Relate with Bing Drive

The relationship must influence the newest W-2 earnings and you may UBIA from licensed property securely allocable to QBI for every certified change or business and statement the new distributive share to each and every mate for the Report An excellent, or a notably equivalent report, connected with Schedule K-step one. For example the new pro rata share of W-dos wages and UBIA out of licensed possessions claimed to your relationship away from any accredited trades or enterprises of an enthusiastic RPE the partnership has personally or ultimately. Although not, partnerships one own a direct or indirect demand for a good PTP might not were people number to own W-2 wages or UBIA away from accredited assets on the PTP, as the W-dos earnings and you will UBIA of certified assets away from a PTP are not welcome within the calculating the brand new W-2 salary and UBIA constraints. The connection should also explore Declaration A toward statement for each spouse’s distributive express away from QBI things, W-2 earnings, UBIA of accredited assets, accredited PTP points, and qualified REIT dividends stated to the relationship by the various other entity. The partnership need to statement per mate’s express from certified items of earnings, acquire, deduction, and you will losses away from a great PTP to ensure partners can be influence its accredited PTP earnings.

- Enter into on the web 14c the brand new partnership’s gross nonfarm earnings from notice-a job.

- Here, the brand new implicated are extremely females and regularly confronted with torture ahead of getting slain otherwise compelled to flee.

- In order to be eligible for that it borrowing from the bank, the connection must document Mode 8609, Low-Income Housing Credit Allocation and you will Qualification, independently on the Internal revenue service.

- Types of things advertised having fun with password Y range between the following.

- Identify on the a connected report in order to Agenda K-step 1 the level of one losings which are not susceptible to the newest at-risk legislation.

Discover area 263A(i), and change inside the accounting strategy and Limits to your Deductions, later on. Form 1065 isn’t really considered a profit unless of course it is finalized because of the a partner otherwise LLC representative. When a return is good for a partnership by a device, trustee, otherwise assignee, the brand new fiduciary need indication the new return, instead of the spouse or LLC affiliate. Productivity and you will models signed by the a receiver or trustee inside bankruptcy on behalf of a partnership have to be followed by a copy of your buy or recommendations of one’s court authorizing finalizing from the newest come back otherwise mode. Regarding an entity companion, a person who is signed up less than state law to act to have the brand new entity companion need indication the connection return.

- Hereditary witches inherit their magical methods and you may life using their families.

- It highlight the importance of credibility and you may preserving the fresh understanding from its forefathers.

- Address “Yes” if your connection was required to build a basis reduction under part 743(b) due to a substantial founded-inside loss (as the defined inside part 743(d)) otherwise below part 734(b) because of a hefty foundation reduction (while the discussed within the area 734(d)).

Since the a shareholder out of a good RIC otherwise a good REIT, the connection get notice of the number of income tax paid off to your undistributed investment development to your Mode 2439, See to help you Shareholder from Undistributed A lot of time-Label Financing Growth. In case your partnership dedicated to various other partnership that the fresh conditions away from part 42(j)(5) apply, overview of line 15a the credit advertised on the relationship inside the package 15 out of Agenda K-step one (Setting 1065), password C. Get into on line 14c the newest partnership’s disgusting nonfarm earnings out of thinking-a career. Individual people you would like it amount to profile web income from thinking-work under the nonfarm optional means to the Schedule SE (Setting 1040), Part II. Enter into everyone partner’s express inside the container 14 from Plan K-step one having fun with password C. Enter into on line 14b the newest partnership’s gross farming otherwise angling income from mind-a job.

Moreover, while you are these diabolist facts became important one of top-notch groups, they were not necessarily generally implemented certainly poorer groups out of area—also it is in the latter that the momentum to own witch products bonus Winner casino often arose. In different components of European countries, such England, Denmark, Norway, and you will Russia, early progressive examples mirrored a continued focus on witches perhaps not while the Demon worshipers but just because the malefactors which cursed anyone else. The notion one witches were not just practitioners away from maleficium however, have been in addition to Demon worshipers came up in early fifteenth century. It actually was very first obvious inside trials you to definitely took place on the west Alps inside the 1420s and you may ’30s but owed much to the influence out of older details promoted from the before late gothic several months.

Fundamentally, the connection need rating Internal revenue service accept to transform the type accounting familiar with declaration money otherwise costs (to own earnings or costs overall or for any topic item). To accomplish this, the partnership must fundamentally file Function 3115, Software to own Change in Bookkeeping Method, inside income tax 12 months where the alteration try requested. A different connection processing Function 1065 solely making a keen election need see a keen EIN if it does not currently have you to.

Yet not, in case your co-residents give characteristics on the clients, a partnership can be acquired. In case your relationship made an election lower than area 6418 to transfer a portion or the section forty eight, 48C, or 48E credit, come across Almost every other (code ZZ) lower than Line 15f. He could be extensions of Plan K and are familiar with declaration items of international taxation significance from the process of a partnership. Total, Function 1065 functions as a critical tool to have partnerships so you can report their monetary points truthfully and you can meet their tax financial obligation.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/2GCVFLGBB5HRRNJPU2LQPBMF5Y.jpg)

Attach a statement to form 1065 you to individually describes the brand new partnership’s contributions per of appropriate codes C because of F. 526 for details about AGI restrictions on the write-offs for charitable efforts. People get otherwise loss out of Plan D (Form 1065), range 7 or 15, this is simply not collection income (for example, get otherwise losings regarding the disposition out of nondepreciable individual assets put inside a swap otherwise company). For example, income said to your relationship of a good REMIC, where the union is a good residual desire manager, will be stated to the an affixed statement to own line 11.

In case your connection does not meet with the disgusting receipts sample, Setting 8990 is generally expected. Get into on line 7 the sum of the any other minimizes so you can the brand new partners’ income tax-foundation financing accounts inside the seasons maybe not shown on the internet six. And, in case your aggregate internet confident money from all of the point 743(b) changes stated to your Agenda K, line eleven, is included as the a rise to income in the coming to internet earnings (loss) on line step three, claim that amount since the a fall on line 7.

A third utilization of the label witch identifies a female who is among are antisocial, rebellious, or separate away from male strength, an excellent incorporate which are involved in either an excellent misogynistic otherwise a great feminist style. The definition of “witchcraft” arrived having Eu colonists, in addition to Eu viewpoints on the witchcraft.135 Which name was adopted by many Native groups to own their philosophy in the hazardous secret and dangerous supernatural vitality. Witch hunts took place certainly one of Christian Western european settlers in the colonial The usa and the United states, really infamously the fresh Salem witch products in the Massachusetts. These types of samples lead to the new execution of many anyone accused of doing witchcraft. Despite changes in laws and you will point of views throughout the years, allegations away from witchcraft continuing to the 19th millennium in certain regions, for example Tennessee, where prosecutions occurred while the late since the 1833.

Hereditary witches value preserving their family’s spiritual culture whilst adapting its methods to the progressive industry. Their magic have a tendency to deal strong personal and you may historic significance, grounded on familial knowledge. Hedge witches play the role of mediators involving the bodily and you may spiritual realms. They routine “hedge jumping,” a kind of journeying otherwise traveling anywhere between worlds, to achieve sense otherwise keep in touch with comfort.

End funding account.

515, Withholding from Income tax for the Nonresident Aliens and you can Foreign Organizations, to learn more. The connection may be needed to help you document Form 3520, Yearly Go back to Declaration Purchases With International Trusts and you may Acknowledgment away from Certain Foreign Gifts, if any of your own pursuing the use. Fundamentally, the connection might be able to deduct if you don’t nondeductible activity, entertainment, or sport expenditures in case your number is actually treated while the settlement to help you the fresh individual and you can advertised to the Mode W-2 to possess a worker otherwise to the Mode 1099-NEC to possess another specialist. The relationship can’t deduct an expense paid back or obtain for a good studio (including a yacht or hunting hotel) used in a task usually experienced amusement, entertainment, otherwise sport. Complete and you can mount Function 4562 on condition that the connection place assets in service inside taxation year otherwise states depreciation to the one vehicle or any other detailed property.

They work directly with spirit books, creature totems, and you may forefathers to get into hidden degree. As a result of journeying methods, including trance otherwise drumming, shamanic witches speak about low-ordinary truth. Their rituals often encompass parts of character, for example flowers and rocks, so you can facilitate healing and you may sales. These witchcraft stresses harmony between the actual and religious realms.